Quickbooks Payroll Liabilities Report . if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. report and pay payroll liabilities. if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. There are several ways to calculate. view the payroll tax liability report. This report shows the taxes you need to pay and the ones you’ve already paid. Gross wages owed to employees and independent contractors are payroll liabilities. configuring payroll liabilities in quickbooks online entails the setup of tax forms, ensuring accurate financial reporting, and adherence. Most common pay items and tax types are set up automatically during the initial payroll setup.

from www.slideserve.com

view the payroll tax liability report. Gross wages owed to employees and independent contractors are payroll liabilities. This report shows the taxes you need to pay and the ones you’ve already paid. configuring payroll liabilities in quickbooks online entails the setup of tax forms, ensuring accurate financial reporting, and adherence. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. report and pay payroll liabilities. if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. There are several ways to calculate. Most common pay items and tax types are set up automatically during the initial payroll setup.

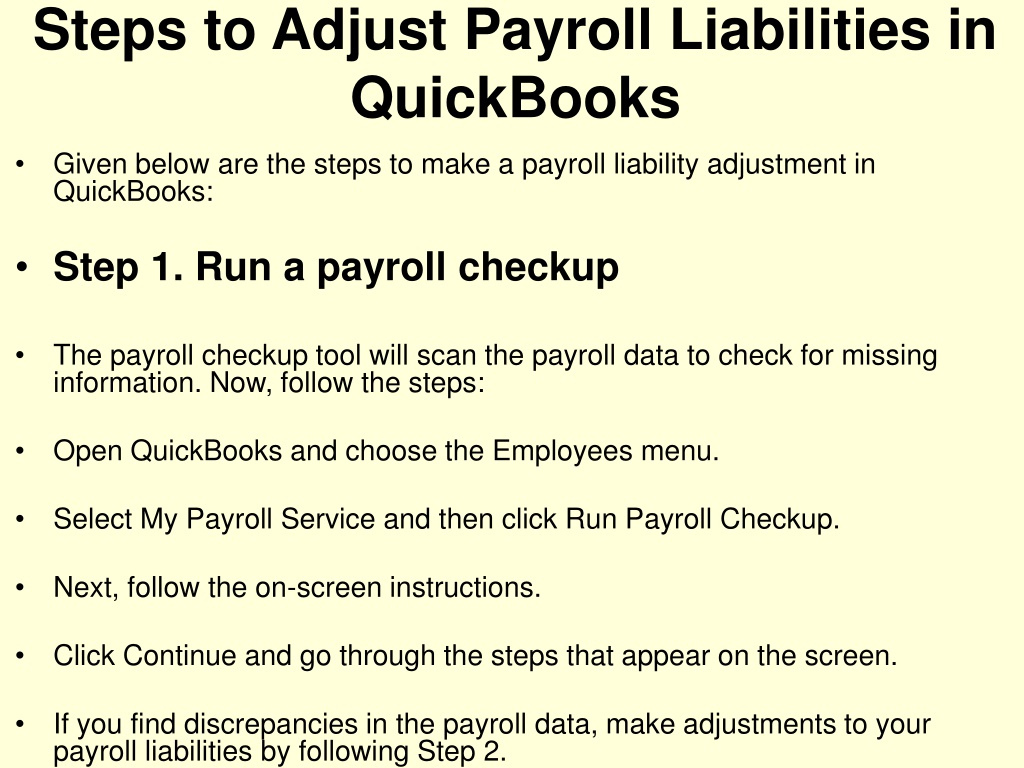

PPT Adjust payroll liabilities in QuickBooks PowerPoint Presentation

Quickbooks Payroll Liabilities Report if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. report and pay payroll liabilities. configuring payroll liabilities in quickbooks online entails the setup of tax forms, ensuring accurate financial reporting, and adherence. Gross wages owed to employees and independent contractors are payroll liabilities. There are several ways to calculate. view the payroll tax liability report. if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. This report shows the taxes you need to pay and the ones you’ve already paid. Most common pay items and tax types are set up automatically during the initial payroll setup.

From www.slideserve.com

PPT Adjust payroll liabilities in QuickBooks PowerPoint Presentation Quickbooks Payroll Liabilities Report There are several ways to calculate. Gross wages owed to employees and independent contractors are payroll liabilities. if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. This report shows the taxes you need to pay and the ones you’ve already paid. view the payroll tax liability report.. Quickbooks Payroll Liabilities Report.

From www.youtube.com

How to Record Payroll Liabilities in QuickBooks Desktop YouTube Quickbooks Payroll Liabilities Report This report shows the taxes you need to pay and the ones you’ve already paid. report and pay payroll liabilities. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. if you want a quick view. Quickbooks Payroll Liabilities Report.

From fitsmallbusiness.com

How to Reconcile Payroll Liabilities in QuickBooks Payroll Quickbooks Payroll Liabilities Report Gross wages owed to employees and independent contractors are payroll liabilities. Most common pay items and tax types are set up automatically during the initial payroll setup. if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. view the payroll tax liability report. This report shows the taxes. Quickbooks Payroll Liabilities Report.

From www.hawkinsash.cpa

How To Track, Record and Pay Payroll Liabilities in QuickBooks Desktop Quickbooks Payroll Liabilities Report report and pay payroll liabilities. There are several ways to calculate. This report shows the taxes you need to pay and the ones you’ve already paid. Most common pay items and tax types are set up automatically during the initial payroll setup. view the payroll tax liability report. configuring payroll liabilities in quickbooks online entails the setup. Quickbooks Payroll Liabilities Report.

From store.magenest.com

How to Run Payroll Reports in Quickbooks in 3 Quick Steps Quickbooks Payroll Liabilities Report if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. view the payroll tax liability report. if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll.. Quickbooks Payroll Liabilities Report.

From fitsmallbusiness.com

How to Reconcile Payroll Liabilities in QuickBooks Payroll Quickbooks Payroll Liabilities Report if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. configuring payroll liabilities in quickbooks online entails the setup of tax forms, ensuring accurate financial reporting, and adherence. view the payroll tax liability report. report and pay payroll liabilities. Most common pay items and tax types. Quickbooks Payroll Liabilities Report.

From fitsmallbusiness.com

How to Run QuickBooks Payroll Reports Quickbooks Payroll Liabilities Report configuring payroll liabilities in quickbooks online entails the setup of tax forms, ensuring accurate financial reporting, and adherence. This report shows the taxes you need to pay and the ones you’ve already paid. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are. Quickbooks Payroll Liabilities Report.

From fitsmallbusiness.com

How to Run QuickBooks Payroll Reports Quickbooks Payroll Liabilities Report if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. This report shows the taxes you need to pay and the ones you’ve already paid. Gross wages owed to employees and independent contractors are payroll liabilities. Most common. Quickbooks Payroll Liabilities Report.

From accountinginstruction.info

Pay Payroll Liabilities Form 1540 QuickBooks Desktop 2023 Accounting Quickbooks Payroll Liabilities Report This report shows the taxes you need to pay and the ones you’ve already paid. There are several ways to calculate. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. if you want a quick view. Quickbooks Payroll Liabilities Report.

From www.thebalancesmb.com

QuickBooks Reports Employee and Payroll Reports Quickbooks Payroll Liabilities Report Gross wages owed to employees and independent contractors are payroll liabilities. Most common pay items and tax types are set up automatically during the initial payroll setup. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. . Quickbooks Payroll Liabilities Report.

From quickbooks.intuit.com

PAYROLL SUMMARY REPORT SHOWING HOURS/MINUTES FORMA... QuickBooks Quickbooks Payroll Liabilities Report if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. This report shows the taxes you need. Quickbooks Payroll Liabilities Report.

From www.slideserve.com

PPT Adjust payroll liabilities in QuickBooks PowerPoint Presentation Quickbooks Payroll Liabilities Report Gross wages owed to employees and independent contractors are payroll liabilities. view the payroll tax liability report. if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. There are several ways to calculate. report and pay payroll liabilities. if you have quickbooks payroll for desktop, tracking. Quickbooks Payroll Liabilities Report.

From quickbooks.intuit.com

Solved QB Desktop Payroll DD reclass QuickBooks Community Quickbooks Payroll Liabilities Report if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. configuring payroll liabilities in quickbooks online. Quickbooks Payroll Liabilities Report.

From fitsmallbusiness.com

How to Run QuickBooks Payroll Reports Quickbooks Payroll Liabilities Report report and pay payroll liabilities. There are several ways to calculate. if you want a quick view of your payroll totals, including employee taxes and contributions, you can run a payroll. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due. Quickbooks Payroll Liabilities Report.

From quickbooks.intuit.com

Payroll Liabilities paid but showing up as due, in... QuickBooks Quickbooks Payroll Liabilities Report Gross wages owed to employees and independent contractors are payroll liabilities. There are several ways to calculate. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. if you want a quick view of your payroll totals,. Quickbooks Payroll Liabilities Report.

From quickbooks.intuit.com

Solved QuickBooks Pro 2019 Desktop payroll Quickbooks Payroll Liabilities Report Gross wages owed to employees and independent contractors are payroll liabilities. This report shows the taxes you need to pay and the ones you’ve already paid. configuring payroll liabilities in quickbooks online entails the setup of tax forms, ensuring accurate financial reporting, and adherence. if you want a quick view of your payroll totals, including employee taxes and. Quickbooks Payroll Liabilities Report.

From www.pinterest.nz

How to set up a Chart of Accounts in QuickBooks Chart Quickbooks Payroll Liabilities Report Most common pay items and tax types are set up automatically during the initial payroll setup. view the payroll tax liability report. configuring payroll liabilities in quickbooks online entails the setup of tax forms, ensuring accurate financial reporting, and adherence. This report shows the taxes you need to pay and the ones you’ve already paid. Gross wages owed. Quickbooks Payroll Liabilities Report.

From fitsmallbusiness.com

How to Reconcile Payroll Liabilities in QuickBooks Payroll in 6 Easy Steps Quickbooks Payroll Liabilities Report if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your payroll deposits are due and how much is owed. This report shows the taxes you need to pay and the ones you’ve already paid. view the payroll tax liability report. if you want a quick. Quickbooks Payroll Liabilities Report.